Do you want to know the VAT applicable to a user of an online store? In this post, we provide you with a guide on how to easily enrich your data.

What assumptions must be taken into account to apply VAT in an online store?

Do you have an online store and you aren’t sure about what VAT to apply when billing a customer?

First, you need to be sure about what tax rate (general, reduced or super-reduced) is necessary to apply.

Besides, you must know the user’s physical location to apply the VAT, taking into account the following assumptions:

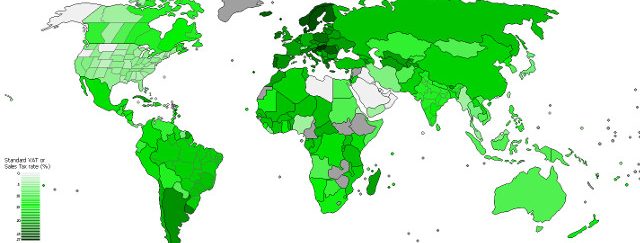

- If your Ecommerce is based on Spain and you sell to the peninsula and Balearic islands, the invoice must include the VAT according to the product type (21%, 10% o 4%).

- If the products are to be transported outside of Spain and

- If the client resides in the Canary Islands, Ceuta or Melilla, it is considered as an export and the invoice is VAT-free, wherever it is a company or a particular.

- If the buyer is a private and resides in Europe, the invoices bear the VAT of the product, but if you sell services, invoices must include the VAT rate of the country.

- If the buyer is an EU company, they will liquidate the VAT in their country, and you do not have to include the VAT in the invoices. The company must provide a tax code in order to declare the operation.

What do I need to know to apply the correct VAT rate in a store?

To determine the VAT applied to a purchase and reflect it in the invoice, you must know if the user is an individual or a company.

Besides, it is necessary to obtain from your user some of the following fields:

- Postal address

- IP address

- Landline or mobile phone with international prefix

- Coordinates (latitude and longitude)

Besides, in the case of a company or self-employed individual, you need to know if the tax identification number is valid to apply or not the VAT on the invoice.

How does UProc help you in the enrichment process?

UProc was born with the goal of providing all the necessary utilities to debug, validate, enrich and unify all your data sources in a centralized and categorized catalog, with multiple data families and typologies.

In the case that you want to enrich the values of your data sources by obtaining the VAT from IP, you can access the Catalog, and follow these steps:

- Type “IVA” in the Catalog searcher and press Enter.

- Click on any of the found tools:

- VAT by address.

- VAT by IP.

- VAT by coordinates.

- VAT by phone.

- VAT exists (European tax number).

- Once you are in the tool, you can verify any value of your data sources, or consult the available examples selecting the “Try Now” option.

After verifying the value of the service, you can see the result of your request below the entry data.

To easily integrate you can use our API. If you click the link “Show API information” you may find examples in multiple programming languages to accelerate the integration process with UProc.

Can I enrich multiple values with UProc?

To validate multiple emails you have to register and use the Processing Assistant (uploading a file –Excel or CSV-) or to make a call to the API.

Do you need a better understanding of what the enrichment entails?

You can read our entry about How to treat your data (III): Completion , to answer your questions about the validation process.

Besides, we are at your disposal from the chat or the contact form, to address any question or query you might have about the service.

Best,

uProc team